Sarasota Insurance Agency >> blog

Renters insurance also called home and contents insurance covers your belongings from theft and damage. It provides liability coverage if someone is injured while in your apartment. Part of that liability coverage, which is typically about $2,000, is to pay the injured person's medical bills. It can also pay for any lawyer fees and settlements.

Renters insurance will pay for the loss of use of your apartment, meaning you can receive payment to stay in a hotel or other place if your apartment is damaged by a fire, storm or another covered event. It covers your belongings while off premises, which means your belongings are covered while you are traveling or if you leave them in your car. For example, if your laptop is stolen from your car or if your luggage is stolen while on vacation, you can file a claim and receive payment.

There are a few broad reasons for you to purchase contents insurance. They include theft of your belongings and damage to your belongings caused by fire, lightning, windstorms, hail, explosions, smoke, vandalism and plumbing leaks. Let's review a few specific scenarios that emphasize the top reasons to purchase renters insurance.

Theft

If you have a computer, you know how valuable it is for storing data, running applications, scrolling the web and entertainment purposes such as streaming video. The documents, data, photos, and videos you keep on your computer are irreplaceable. Most renters insurance offers a standard payout, often replacement value, if your computer is stolen or damaged. If you feel you need additional coverage, you can purchase an endorsement, or extra coverage, for your computer, as well as other items such as jewelry, silverware, firearms, business personal property and almost anything you want to insure.

Fire

You come home one evening and fire trucks and firefighters are wrapping up hoses and stowing their firefighting gear on the fire truck parked outside your apartment building. Your neighbor fell asleep with a lit cigarette. Your apartment did not burn, but it and everything in it including your clothes were damaged by smoke. Renters insurance can pay you for your loss and pay for a place to stay while the damage is repaired.

Water Damage

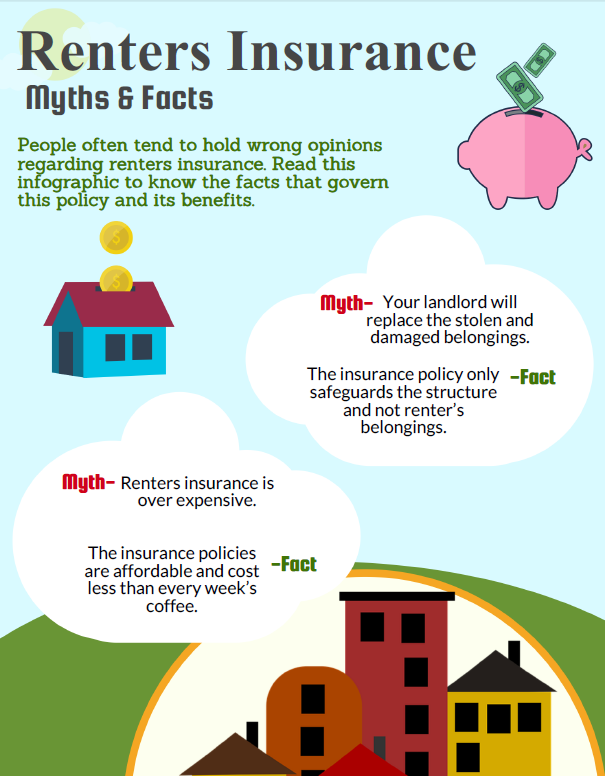

A pipe bursts in your ceiling while you're at work and pours water onto your great grandmother's Stickley rocking chair. The leather upholstery is ruined. It's a notable antique and worth a pretty penny. Your renter's insurance will pay to repair the rocker. It's important to have renters insurance because your landlord's insurance doesn't usually cover your personal belongings.

Personal Injury

While visiting your apartment to introduce herself, your nosy neighbor who plays her music too loud and can't seem to park between the lines in the parking garage slips on some raspberry yogurt and knocks herself unconscious. She hits her head on the counter and needs a few stitches. Your renter's insurance will cover your liability for her injuries. It typically provides liability coverage from $100,000 to $500,000, which is ample. If you desire more or less, you can purchase up to $2 million or as little as $50,000 in liability coverage.

Summary

Renters insurance is affordable and worthwhile. You can get renters insurance quotes online, which makes shopping for this must-have insurance simple and easy. If your belongings are stolen, damaged or destroyed by fire, storms, smoke, vandalism or other covered causes, renters insurance provides you with peace of mind because you know they'll be replaced.

Original Source: https://www.toptenreviews.com/services/articles/top-reasons-to-purchase-renters-insurance/2019-02-12 11:23:26