Sarasota Insurance Agency >> blog

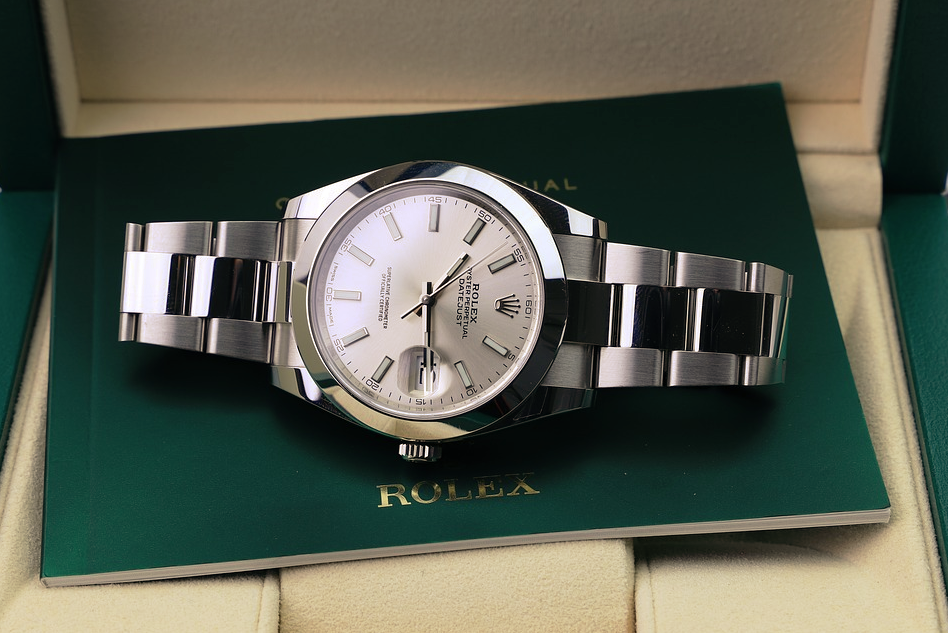

Homeowner insurance coverage protects more than just your house. Valuable item insurance included in your policy can be used to insure your valuables such as jewelry, art, prized collections or antiques that can mean just as much to you as the home itself. When you are ready to purchase home insurance coverage, make sure it covers your valuables as well as your home!

Limits on Valuable Item Insurance

If you own a home or you are renting a home or apartment then things such as furs, jewelry, silver, gun or coin collections or antiques, can be covered on your homeowners insurance policy to protect against damage or theft. However, you need to realize that your home contents coverage only protects you up to a limit. If your valuables are worth more than the policy limits, you might find yourself out of luck on replacing them in the event of a loss. Make sure you read your homeowners insurance policy thoroughly for any valuable item insurance limits that you are subject to. Some common dollar limits for valuable items are:

These items are subject to your homeowners deductible, and are also subject to any exclusion set forth in your home insurance coverage. Consider the following two examples to see when your policy coverage can come up short, and when it won't cover you at all:

TIP: Know your policy limits before hand, and increase them if you feel like they are too low. You will have to pay more to the insurance company, but it may be worth it to protect your valuables.

Benefits of a Valuable Item Insurance Rider

If any of your valuable items are worth more than the list outlined above, you need a valuable item home insurance rider added to your homeowner's insurance policy. Sometimes called a Personal Article Floater or Jewelry Floater, these valuable item insurance riders provides the added insurance coverage for the most valuable items that are inside your home. There are three major benefits of a valuable item insurance rider.

This is a huge benefit! Depending on the value of your items, these riders can be very economical, costing on average around $200 a year. The rider would list each item specifically with a description and value. An up to date and formal appraisal may be requested to verify its insured value. It is generally your choice whether to replace the item if it is a total loss or to simply take the money. There are many variations to a personal article floater or valuable item insurance rider. Therefore, make sure you understand the rider you purchase.

TIP: Make sure you periodically updated the value of your scheduled items by providing the insurance company with an updated appraisal of the item every 3 years or so. This will ensure you receive the true value of the item in the event you have to make a claim.

When you are ready to purchase a homeowner's insurance policy, consider whether or not it is worth it to include your valuable items and antiques in your insurance protection. To get a quote on adding a valuable item insurance rider to your home insurance coverage,

The article was written by Free Advice Insurance2019-10-14 16:28:58